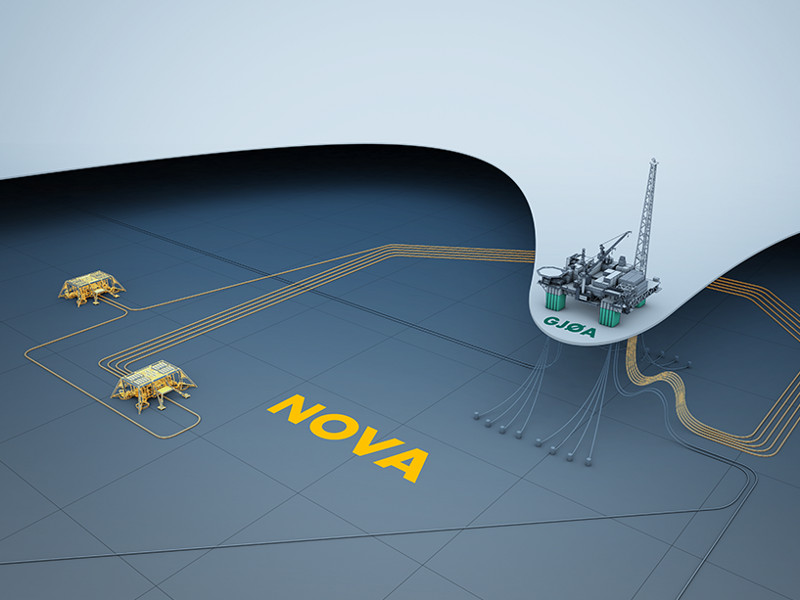

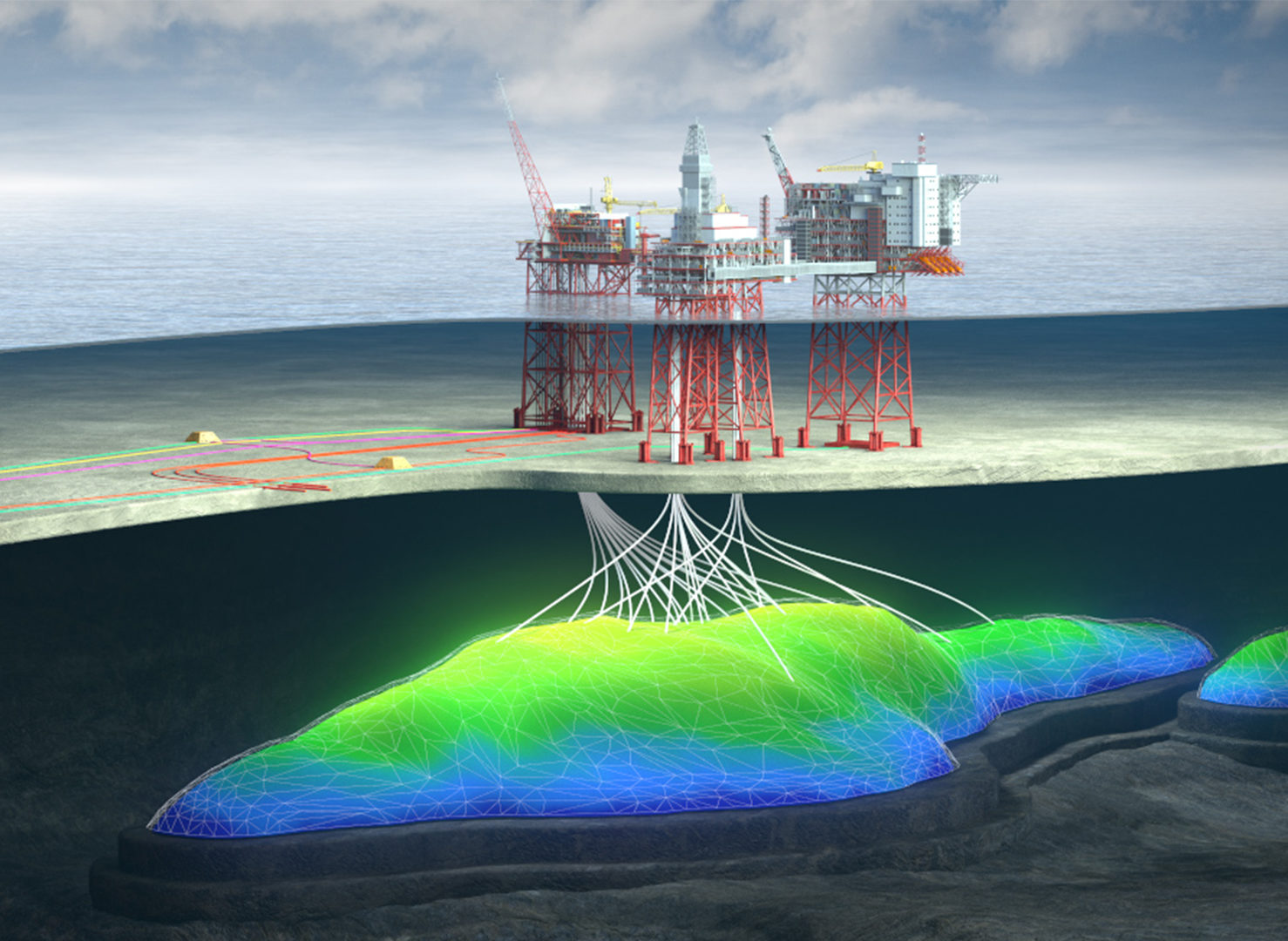

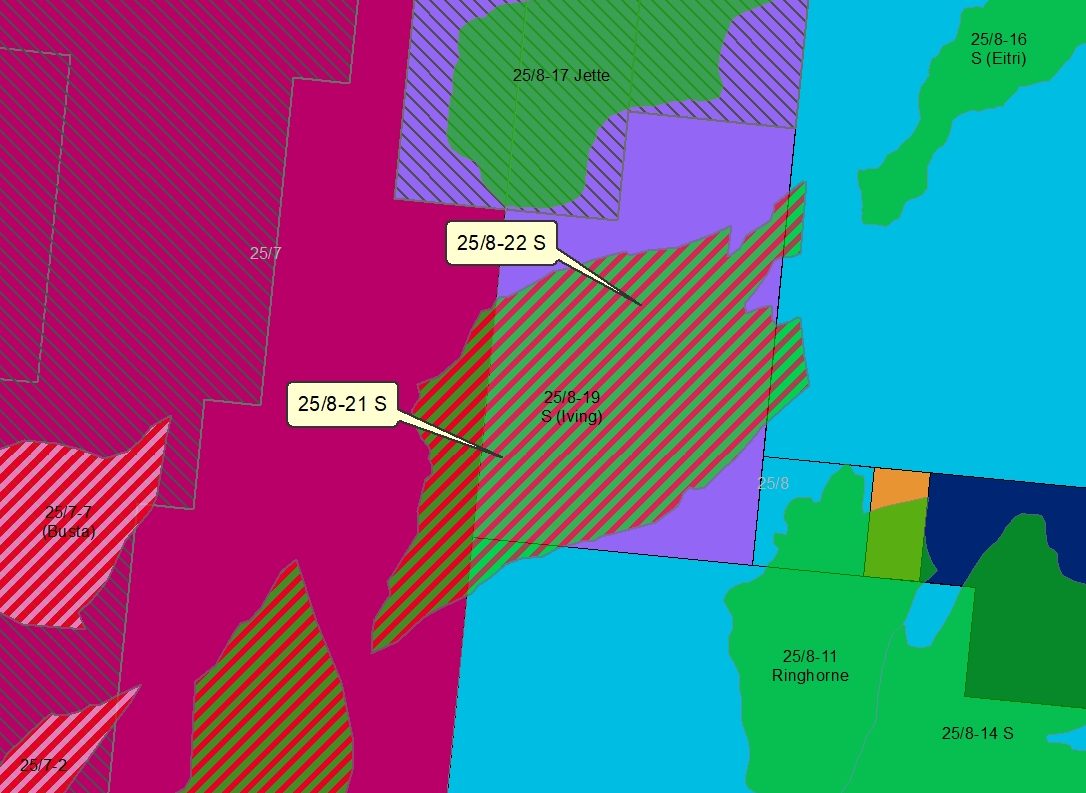

The Nova field is expected to start production in the second half of 2022. The field, located in the northern part of the North Sea, is being developed with two subsea templates tied back to the existing Gjøa platform. Nova (previously Skarfjell) was discovered in 2012 and the plan for development and operation (PDO) was approved in 2018. The use of existing infrastructure enables effective extraction of the resources and Nova will be sustainably operated with hydro power from shore through Gjøa.

CEO of Pandion Energy, Jan Christian Ellefsen stated the following:

This transaction represents a new leap in the Pandion story and secures the foundation for further growth. Our asset base is strengthened and, with Nova on stream, our daily production will more than double.

“During the first five years, Pandion Energy has earned its reputation as a trusted partner in exploration and field development on the Norwegian Continental Shelf (NCS). ONE-Dyas Norge fits well with our existing portfolio and organisation and will strengthen our position as an active, full-cycle partner driving value in high-quality assets on the NCS.”

Through its 10 percent ownership in the Valhall and Hod fields, Pandion Energy currently produces over 5,000 barrels of oil equivalent per day, set to increase further as the new Hod B platform comes on stream in 2022. The Valhall area has been fully electrified from shore since 2013. The combined Valhall and Nova production will, in line with Pandion Energy’s Net Zero Carbon strategy, have among the lowest CO2 intensity levels on the NCS.

Jan Christian Ellefsen further points out that Pandion Energy has long indicated plans for further expansion on the Norwegian Continental Shelf:

“M&A activity on the NCS was slow during the first half of 2021, but more opportunities started to occur as we approached 2022. We are still actively searching for and evaluating additional opportunities to further grow our portfolio.”

The transaction is subject to customary conditions for completion, including but not limited to approval by the Norwegian Ministry of Petroleum and Energy.

For more information on ONE-Dyas Norge AS, see: https://onedyas.no/

For more information on Nova, see: https://www.norskpetroleum.no/en/facts/field/nova/