Reference is made to the press release dated 4. December 2017 regarding Pandion Energy entering into an agreement with Aker BP ASA (Aker BP) to acquire a 10 percent interest in the Valhall area, including licences PL006B, PL033 and PL033B.

All closing conditions have been fulfilled, and the closing of the transaction took place on 22 December 2017.

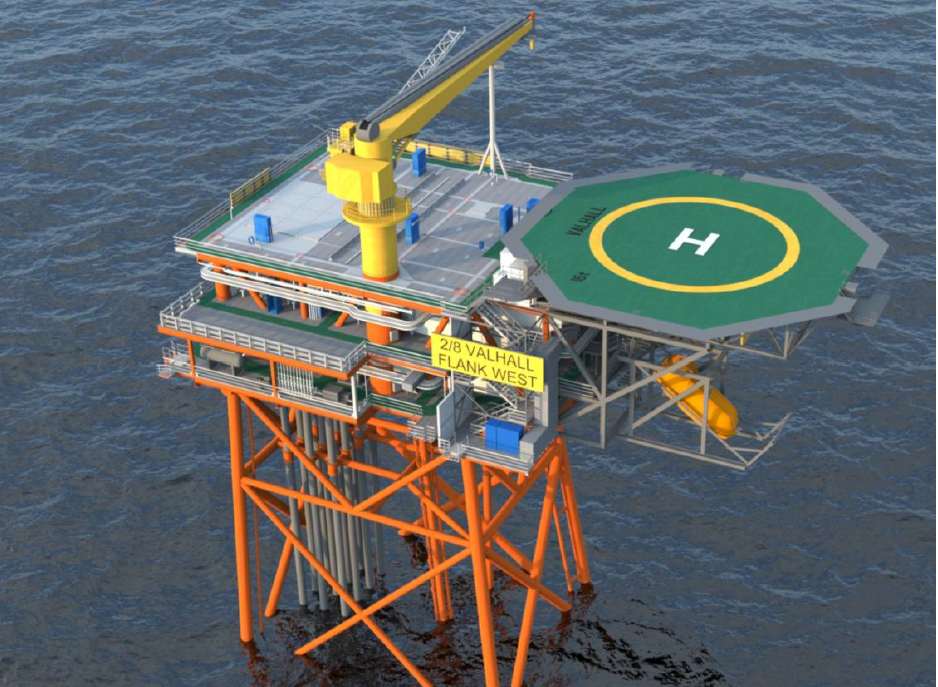

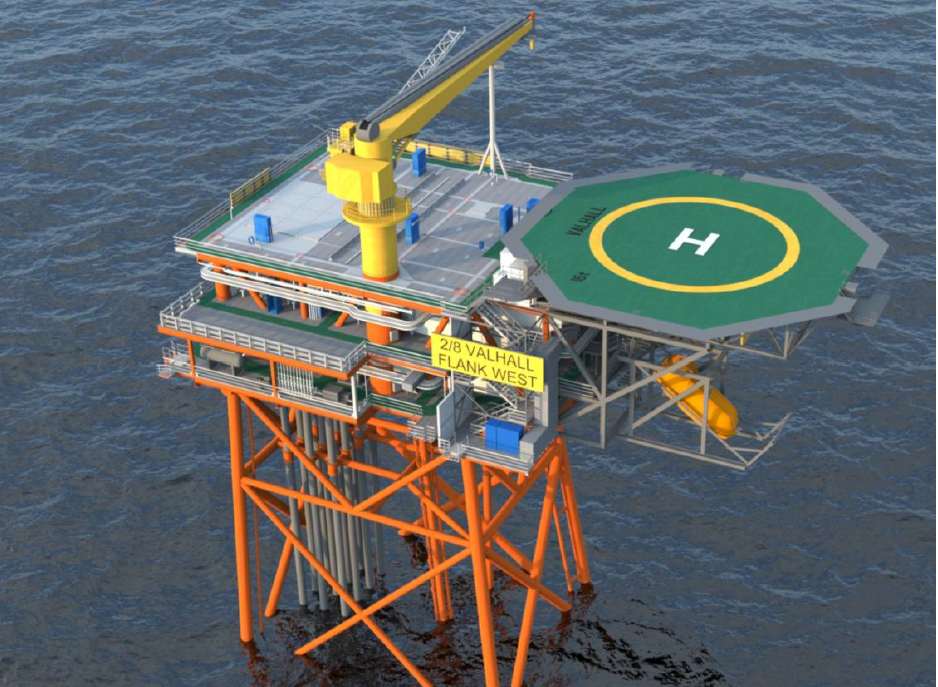

Valhall is one of the largest oil fields in the southern part of the Norwegian sector in the North Sea. Together with Hod field over one billion barrels of oil equivalent has been produced. Aker BP, the operator of Valhall field, has stated an ambition to produce at least an additional 500 million barrels of oil equivalent. Earlier this month, Aker BP announced submittal of Plan for Development and Operation (PDO) for Valhall Flank West.

The Valhall Flank West project aims to continue the development of the Tor formation in Valhall on the western flank of the field, with startup of operation in fourth quarter 2019. Recoverable reserves for Valhall Flank West are estimated to be around 60 million barrels of oil equivalent.

For more information on Valhall, please see: https://www.akerbp.com/en/our-assets/production/valhall/