Jan Christian Ellefsen, CEO of Pandion Energy, stated the following:

As we reflect on the journey of Pandion Energy through 2023, the year stands out as a year with focus on unlocking the inherent value of our portfolio and ensuring safe and efficient operations and production.

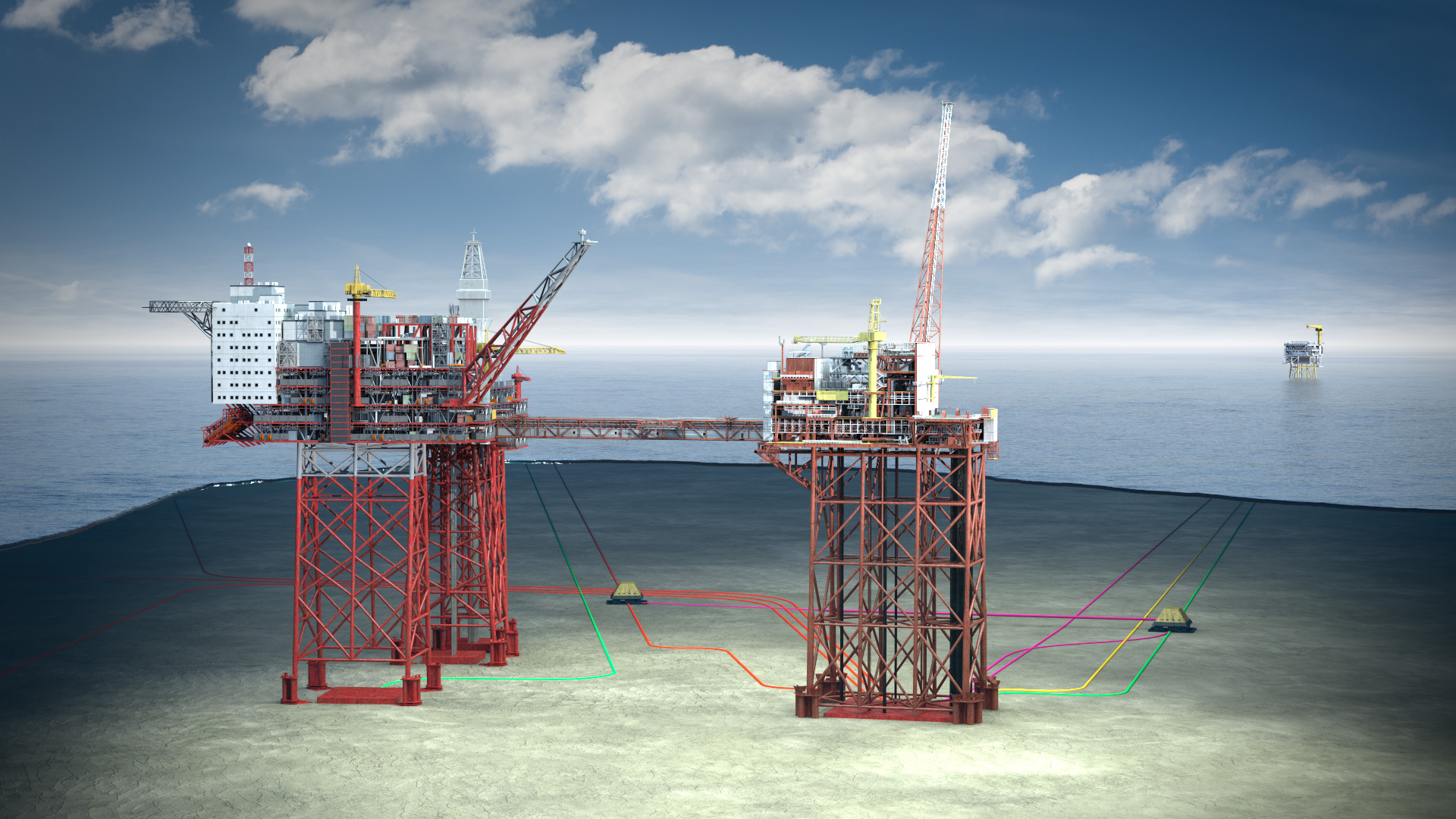

“The Valhall, Hod and Nova fields have not only met, but surpassed our production targets for the year. On Nova, we successfully completed a side-track drilling operation to improve the location of one of the water injector wells. At Valhall, we conducted an effective well intervention campaign leading to an impressive production performance. This performance was achieved despite operational challenges, which included a temporary shutdown at the Valhall and Hod fields. This accomplishment is a testament to our resilience and operational excellence.”

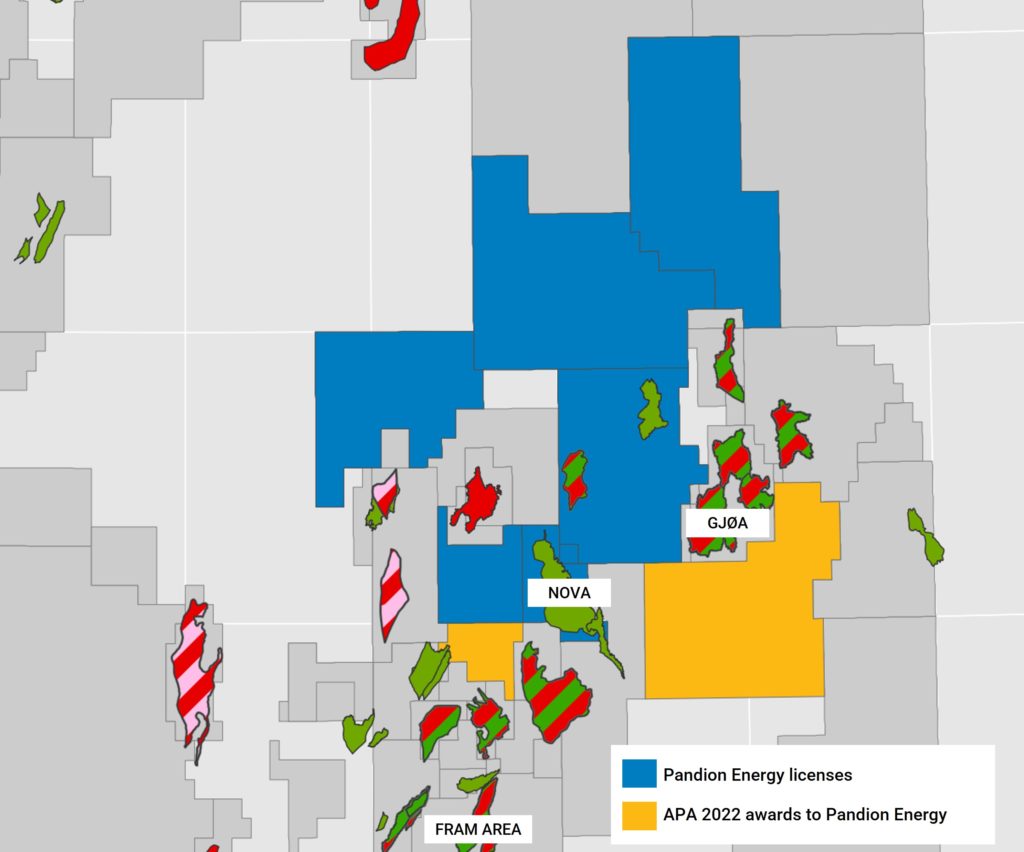

Pandion Energy has over the years built a highly competent team, with extensive subsurface expertise and field development capabilities. Over the company’s seven years, Pandion Energy has made six discoveries out of seven drilling campaigns, representing a success rate exceeding 85 per cent. The company’s core focus remains in the mature areas close to existing infrastructure in the greater Valhall and Gjøa areas of the North Sea, and the Haltenbanken area of the Norwegian Sea.

“Our financial trajectory in 2023 has been nothing short of impressive, with a record-breaking turnover of USD 223.4 million and robust EBITDAX margin. Our cost efficiency has been maintained at USD 10 per barrel produced and our carbon footprint for 2023 was 1.5 kilograms of CO₂e per barrel of oil equivalent. This is a carbon intensity per barrel amongst the lowest in the global E&P industry, as well as Norway. I wish to extend a heartfelt thank you to our motivated team and partners. Their strong commitment is the foundation of our success,” Ellefsen continues.

Average net production for Pandion Energy was 8,304 barrels of oil equivalent per day (boepd), an increase of 46 per cent from the average of 5,697 boepd in 2022.

With its strong financial position, Pandion Energy is well positioned for future operations on the Norwegian continental shelf. The company remains committed to its strategy of being an active and responsible partner, and a full-cycle oil and gas company with long-term ambitions.