Pandion Energy has had a flying start since inception in November 2016, outperforming the main objectives set out for the first year as a new company.

“We were all excited and eager to get going after securing financial support from Kerogen Capital to execute the management buy-out of Tullow Oil’s Norwegian operations at the end of 2016. Our initial target was to develop a portfolio of 100 mmboe of reserves and contingent resources. With the acquisition of a 10 percent interest in the Valhall & Hod producing fields from Aker BP ASA (“Aker BP”), Pandion Energy has transformed into a full-cycle oil and gas company, and came close to achieving our target within our first year of existence” says CEO of Pandion Energy, Jan Christian Ellefsen.

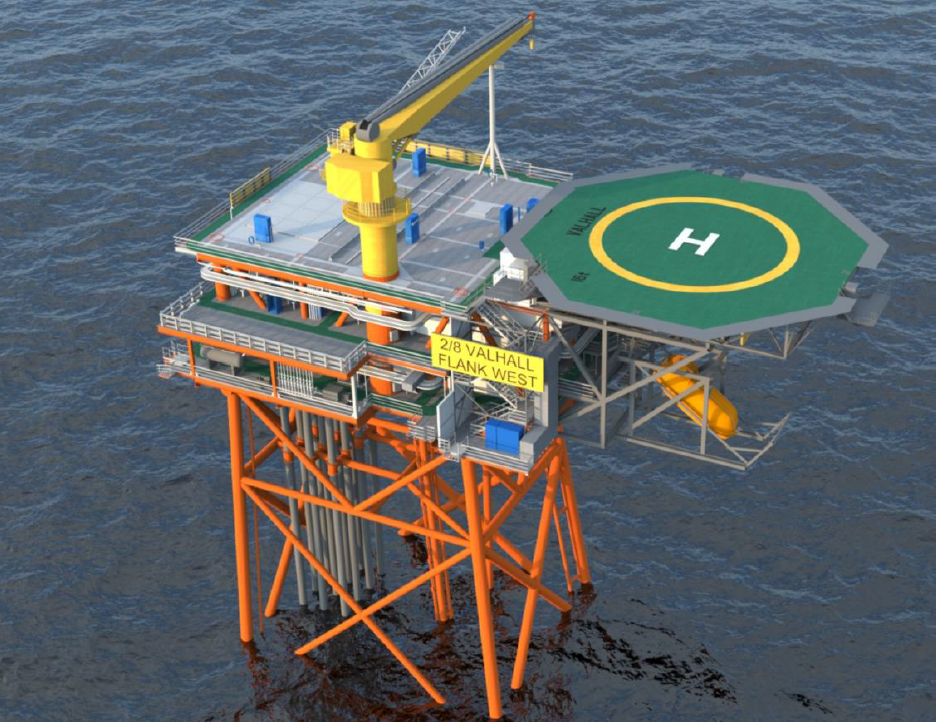

With the acquisition of a 10 percent interest in the Valhall & Hod producing fields from Aker BP, Pandion Energy has transformed into a full-cycle oil and gas company, and came close to achieving our target within our first year of existence.

In December 2017, the combination of a great team effort and strong investor support enabled Pandion Energy to acquire a 10% share of the Valhall & Hod fields from Aker BP. The company was able to evaluate the assets, and negotiate and complete the transaction within only four weeks. The speed of the transaction truly demonstrated Pandion’s ability to move swiftly when attractive opportunities arise.

“The transaction also reflected our team’s technical, commercial and financial capability on the NCS, having worked together for almost ten years. It also showed that matching our competence with that of our majority investor, Kerogen Capital, increases both our confidence and level of precision when considering quality assets such as the Valhall & Hod fields. I was personally pleased to see that we, as a young organisation, truly lived up to our core values; professional, agile, commercial and team player”, tells Jan Christian Ellefsen.

During 2017, Pandion also continued high-grading the existing portfolio with the relinquishment of certain sub-commercial exploration licenses that came with the management buy-out in 2016. The key asset from this transaction, the Cara discovery operated by Neptune Energy, had a material upgrade in resource estimates. The company was also awarded two promising licenses in the 2017 Awards in Predefined Areas (“APA”) licensing round.

An active partner

“In the daily work, Pandion Energy strives to be a active partner in all their licenses by ensuring that operators continue this improvement trend and deliver projects on time and budget. The company works proactively with operators to target upsides in and around proven assets, and continue to seek other attractive growth opportunities through M&A, farm-ins and participation in licensing rounds.

Our ability to create long-term, lasting value rests on maintaining high standards of governance, sustainable business practice and operations.

“Our ability to create long-term, lasting value rests on maintaining high standards of governance, sustainable business practice and operations. Sound business decisions are a product of a strong team, an active board of directors and a competent owner, and 2017 was a year where this symbiosis worked seamlessly. We are very pleased that we now in June also got our efforts confirmed with a clean audit report from the Petroleum Safety Authority of Pandion Energy as a licensee on the NCS”, tells Ellefesen, and continues:

“We are very pleased with the continued support of our financial backer, Kerogen Capital, as well as our bond investors and bank lenders as evidenced by our recent capital raise in April. Coupled with our highly competent team, I am certain that this will enable Pandion Energy to create further value both for our shareholders and the Norwegian society in the years to come.”

Downloads/Links: