Pandion Energy is pleased to announce the discovery of oil and gas in production license 820 S through the drilling of exploration well 25/8-19 S, including sidetracks A and A2.

The exploration well, including sidetracks, proved hydrocarbons at five different intervals.

Preliminary evaluation of the Iving discovery in the Skagerrak Formation shows recoverable resources of between 12 and 71 million boe (of which approx. 85 percent light oil) within the license area.

Recoverable volumes associated with the Evra discovery in the Eocene/Paleocene injectite reservoir sands, oil in weathered/fractured basement and other oil and gas carrying layers will be considered during the appraisal phase of the license.

At Iving, a gross gas column of 34 metres above an oil column of at least 45 metres was encountered in moderate quality Skagerrak reservoirs. The oil-water contact was not encountered in the well.

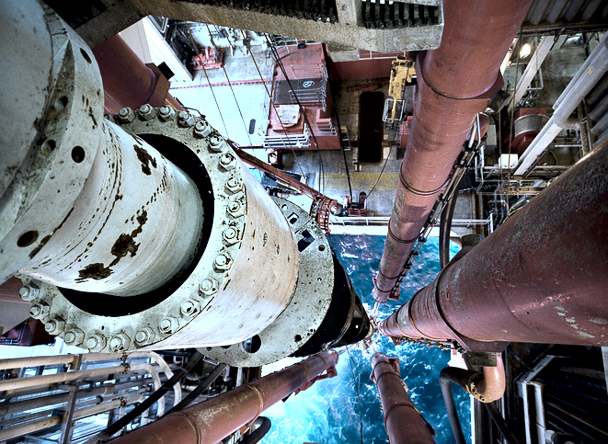

Extensive data collection and sampling was carried out in the wells, including pressure and fluid tests (Mini-DSTs) at multiple levels, as well as a successful well test in the Skagerrak Formation in the sidetrack well. Limited by design of surface equipment, the test was carried out with averaged oil and gas production rates of 475 m3/d and 75 600 m3/d, respectively, on a 32/64’’ choke. The measured GOR through the test averaged at 180 m3/m3, while the measured oil gravity averaged at 40 deg API.

Weathered and fractured basement (below a basal conglomerate) encountered an oil column of minimum 41 meter. The oil-water contact was not encountered.

Managing Director Jan Christian Ellefsen of Pandion Energy says in a comment:

“We are very pleased with making a material discovery in our second exploration well. This demonstrates the potential of our exploration strategy focusing on opportunities close to existing infrastructure. We look forward to maturing the discoveries and remaining prospectivity together with the PL 820 S partnership, as well as to commercialize the resource potential now proven in the license.”

These are the first and second exploration wells in PL 820 S. The permit was granted in APA 2015.

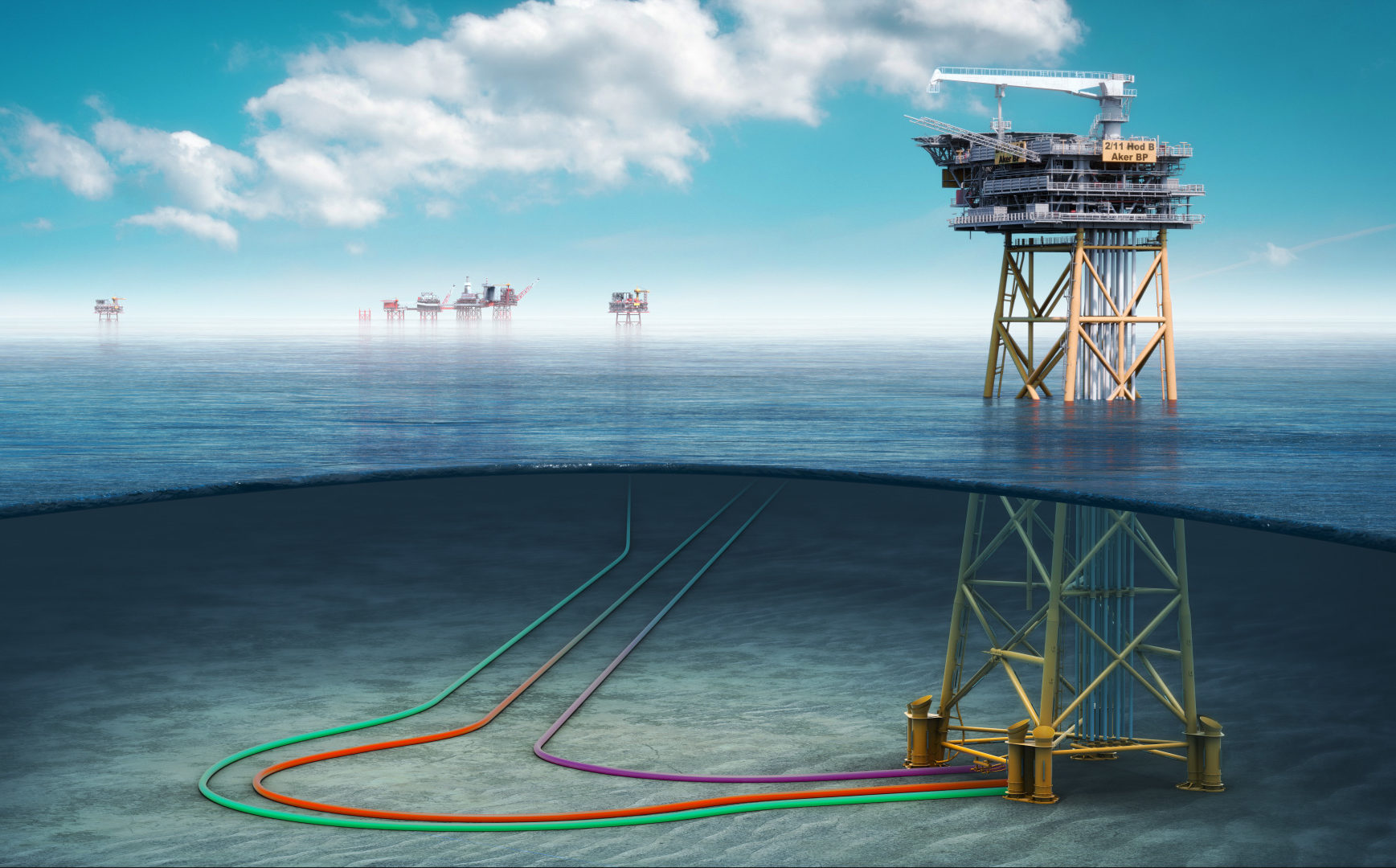

The wells were drilled by the semi-submersible drilling rig Deepsea Bergen approx. 8 kilometres northwest of the Balder and Ringhorne Field in the central part of the North Sea.

MOL Norge is the operator of the production license with a 40 percent participating interest. In addition to Pandion Energy (10 percent), the partnership also consists of Lundin Norway (40 percent) and Wintershall DEA (10 percent).

For further information see press release from the Norwegian Petroleum Directorate: Oil and gas discoveries near the Balder field