Pandion Energy has farmed down a 5% participating interest in PL 820S and 820SB to Vår Energi with effective date 1 January 2022. The transaction is one of multiple transactions bringing Vår Energi’s participating interest in these licenses to 30% in total. Following the transaction, Pandion Energy’s participating interest will be 7.5% in both licenses. It has further been agreed between the partners in PL 820 and 820SB to propose that Vår Energi is appointed operator.

Author: Oksana Hillervik

First oil at the Nova field

CEO Jan Christian Ellefsen of Pandion Energy comments:

“Nova on stream is an important milestone for Pandion Energy as this will more than double our daily production when at peak – a big thanks to all involved for getting us to this stage! We now look forward to work closely with the operator and partners to further enhance production and value creation from the Nova field. I’m also very pleased to see that we’re able to continue delivering profitable growth while remaining loyal to our Net Zero Carbon strategy. Together with the existing production from Valhall & Hod, we will have among the lowest CO2 intensity levels on the Norwegian Continental Shelf.”

The Nova field (previously Skarfjell) was discovered in 2012 and the plan for development and operation (PDO) was approved in 2018. Pandion Energy entered the project through the acquisition of ONE-Dyas Norge AS, which was announced in March this year and completed at the end of June.

About Nova

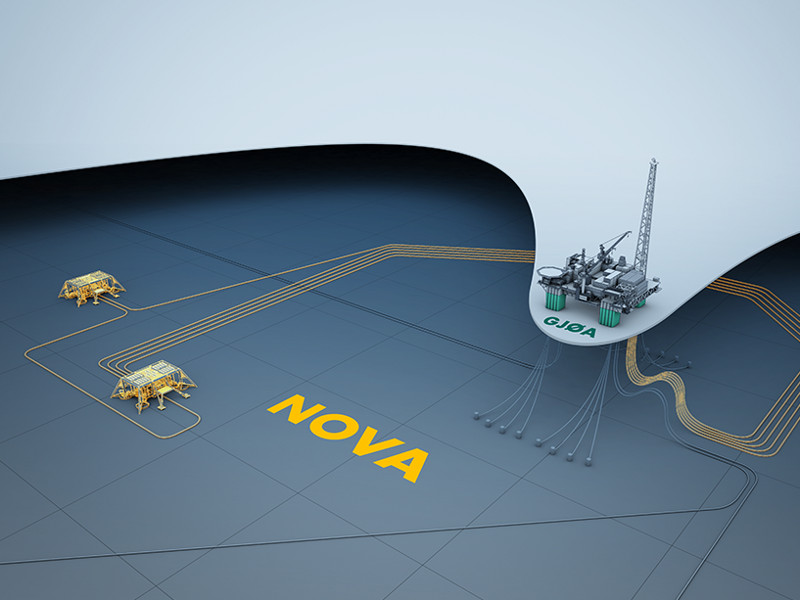

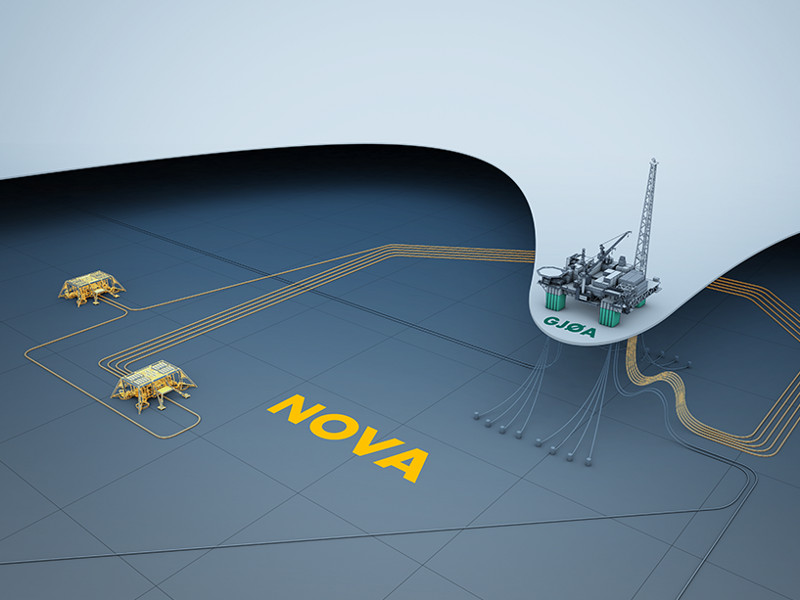

Nova is located in the North Sea, about 120 kilometres northwest of Bergen and approximately 17 kilometres southwest of the host platform Gjøa. The field is developed with two subsea templates and a total of six wells; three producers and three water injectors. The host platform will provide gas lift and water injection to the field and receive the Nova hydrocarbons.

The Nova oil will be transported via Gjøa through the Troll Oil Pipeline II to Mongstad, associated gas will be exported via the Far North Liquids and Associated Gas System (FLAGS) pipeline to St Fergus in the UK, supplying the European energy market.

The Nova partnership consists of Wintershall Dea (45% participating interest and operator), Sval Energi (45%) and Pandion Energy Norge (10%). In May this year, Wintershall Dea announced that it had entered into agreement to sell a 6% participating interest in the Nova field to OKEA.

For more information about Nova, see: https://www.norskpetroleum.no/en/facts/field/nova/

Pandion Energy completes acquisition of ONE-Dyas Norge AS

Following the completion of the transaction, ONE-Dyas Norge AS has become a wholly owned subsidiary of Pandion Energy and the name of the company will be changed to Pandion Energy Norge AS.

The transaction includes a 10 percent share of the Nova field and a total of nine exploration licenses. The Nova field is expected to start production in the second half of 2022 and will be sustainably operated with hydro power from shore through Gjøa.

This transaction represents a new leap in the Pandion Energy story and secures the company a solid foundation for further growth. With Nova on stream, the Pandion Energy’s daily production will more than double from the current level. In line with Pandion Energy’s Net Zero Carbon strategy, the combined Valhall and Nova production will, have among the lowest CO2 intensity levels on the Norwegian Continental Shelf.

In accordance with conditions set forth in the approval by the Norwegian Ministry of Petroleum and Energy, a separate merger process will be initiated to combine the portfolio of the two companies under one licensee.

Pandion Energy completes debt refinancing process

Together with the USD 75 million 4-year tenor senior unsecured bond successfully raised on 25 May, this concludes Pandion Energy’s refinancing process. The purpose of this process has been to optimize the capital structure on the back of the acquisition of ONE-Dyas Norge AS announced on 9 March (completion pending authorities’ approval).

Commenting on the refinancing process, Jan Christian Ellefsen, CEO of Pandion Energy’s said:

“We are very pleased to have completed the debt refinancing as planned under unusually volatile market conditions. We are also comforted by the continued strong support from both leading Nordic and international banks, as well as institutional bond investors. By retaining this diversified and flexible capital structure, we are fully financed to meet exciting commitments and to act on future growth opportunities.”

The bond will be listed on the Nordic ABM, a marketplace regulated by Oslo Børs, within 9 months. Nordic Trustee has been appointed as bond trustee. Upon closing of the new bond issue, Pandion Energy issued a call notice for full redemption of PANE01 PRO earlier today.

ABG Sundal Collier, DNB Markets and Pareto Securities acted as joint lead managers and bookrunners of the bond issue.

Arntzen de Besche acted as legal advisor to Pandion Energy in the refinancing process. RBL banks were advised by Wiersholm and managers of the bond issue were advised by Thommessen.

Delineation drilling results of the Slagugle oil discovery

Analysis of the newly collected data will inform on options for future appraisal and potential development. Pandion Energy holds a 20 per cent interest in in PL891, where ConocoPhillips is the operator (80 per cent). The main objectives of the appraisal well were to narrow oil in place and recoverable hydrocarbon volume estimates for pay intervals encountered in the discovery well 6507/5-10 S.

The well 6507/5-11 was spud on March 8th, 2022. TD (2272.92 m TVDSS) was safely reached on March 30th, 2022. Extensive data acquisition was carried out, including LWD, wireline, formation pressure, fluid samples and dynamic interference testing utilizing pressure gauges installed in the discovery well 6507/5-10 S.

The 6507/5-11 well encountered wet Jurassic and Triassic sands in the Åre formation and Grey Beds, with a total of 130 m of net good reservoir properties in several vertically separated pressure zones.

Three injectivity tests were conducted in the Åre and Grey Beds formations. Good injectivity in high permeability intervals was observed in all zones with a target rate of around 1000 Sm3/day for each injection test. The injection tests interpretation supports good connectivity of the Grey Beds reservoir with the updip pay in the discovery well 6507/5-10 S.

VP Exploration and Appraisal at Pandion Energy, Bente Flakstad Vold, stated the following:

We see multiple exploration opportunities in the Slagugle area which we expect will add to the resources confirmed by this appraisal well. We now look forward to continuing our close cooperation with the operator and contribute to maturing and potentially developing the resources in the area.

For further information see press release from the Norwegian Petroleum Directorate: Delineation of oil discovery 6507/5-10 S (Slagugle) northeast of the Heidrun field in the Norwegian Sea – 6507/5-11 (npd.no)

Pandion Energy successfully places USD 75 million bond

Pandion Energy AS (“Pandion Energy”) is pleased to announce a successful bond issue of USD 75 million with a tenor of 4 years. The bond issue attracted strong interest from Norwegian and international investors. The purpose of the new bond issue is refinancing of the existing NOK 400 million senior unsecured bonds with maturity in April 2023 (ISIN NO 001 0820103) (“PANE01 PRO”) as well as general corporate purposes. Upon closing of the new bond issue, Pandion Energy will issue a call notice for full redemption of PANE01 PRO.

ABG Sundal Collier, DNB Markets and Pareto Securities acted as Joint Lead Managers for the bond issue.

Pandion Energy to hold fixed income investor meetings

Pandion Energy AS (“Pandion Energy”) has engaged ABG Sundal Collier, DNB Markets and Pareto Securities as Joint Lead Managers to arrange fixed income investor meetings. Subject to market conditions and acceptable terms, a new USD senior unsecured bond issue with four year tenor may follow.

The purpose of the new bond issue is refinancing of the existing NOK 400 million senior unsecured bonds with maturity in April 2023 (ISIN NO 001 0820103) (“PANE01 PRO”) as well as general corporate purposes. Subject to successful placement of the new bond issue, Pandion Energy will issue a call notice for full redemption of PANE01 PRO.

Hod B starts production

The first steel for Hod B was cut in Aker Solutions’ yard in Verdal, the day after the Norwegian Parliament adopted temporary changes in the petroleum tax regime in June 2020.

“Production start-up from Hod B less than two years after, is great news! It demonstrates how the temporary tax changes, matured in the spring of 2020 when the industry was paralyzed by a pandemic and a sharp fall in oil prices, has had a real impact. Aker BP and Pandion Energy responded immediately to the politicians’ expectation of creating activity for the supplier industry across the country,” says Karl Johnny Hersvik, CEO of Aker BP.

Aker BP and Pandion Energy responded immediately to the politicians’ expectation of creating activity for the supplier industry across the country.

“There are many who can celebrate the start of profitable production with almost zero CO2 emissions from the Hod field. Through projects like Hod B, we are creating value both for the company, partners, alliance partners, owners and the Norwegian society at large. We are also contributing to sustain a world-leading supplier industry in Norway. I am especially proud of the fact that, through the Hod project, Aker BP has contributed to the vocational training of 50 apprentices”, Hersvik adds.

In line with the rapid sanctioning of Hod B, the project has been both safely and efficiently delivered through a demanding period: 14 months after the first steel was cut in Verdal, the platform was installed offshore – in accordance with the plan.

Strengthening the future of Valhall

Hod B is a normally unmanned wellhead platform, remotely operated from the Valhall field centre. Production from the Hod field will have close to zero CO2 emissions thanks to power from shore.

Aker BP and partner Pandion Energy expects Hod to produce 40 million barrels of oil equivalent.

CEO Jan Christian Ellefsen in Pandion Energy states the following:

This is an important milestone in revitalising the Valhall area and will increase our production on the NCS further. For Pandion Energy, this also marks the successful development of our third PDO, all with a clear environmental profile being powered from shore with ultra-low CO2 emissions.

Publication of the annual report for 2021

Jan Christian Ellefsen, CEO of Pandion Energy, stated the following:

During our first five years in operation, we have grown to become a recognized player in exploration and development on the NCS.

”Our 10 per cent interest in the Valhall area gives us daily production of over 5 000 barrels of oil equivalents. In March 2022, we announced the acquisition of the Norwegian operations of Dutch company ONE-Dyas, which represents a new quantum leap in the Pandion Energy story and secures the foundation for further growth.

This transaction includes a 10 per cent share of the Nova field, which is planned to come on stream in the second half of this year. When that field reaches plateau output, our daily production will be more than doubled. Also nearly doubling our exploration bank, the ONE-Dyas portfolio fits well with our existing holdings. The Nova development is a subsea infrastructure with a low CO2 footprint, well in line with our ESG strategy.

We are entering 2022 with a strong balance sheet which permits further merger and acquisition activities. We remain committed to our strategy of being an active, responsible partner and a full-cycle oil and gas company with long-term ambitions.”

Total revenues and other income for 2021 amounted to USD 135.9 million (2020:USD 116.6 million) and comprised net sales of oil and gas and gain/loss from hedging positions.

The increase in revenue mainly reflected higher commodity prices combined with larger crude oil volumes sold during the fiscal year. Net sales of oil and gas for the year amounted to USD 137.9 million (2020: USD 76.7 million).

Average net production for Pandion Energy was 5 152 boe per day (boepd), compared with an average of 5 639 boepd in 2020. The reduction in produced volumes was a result of planned downtime related to chalk influx in several wells necessitating well intervention activities.

The board considers Pandion Energy to be well positioned for further growth. The company remains committed to its strategy of being an active and responsible partner on the NCS, participating in every phase from exploration through to the development of oil and gas resources.

The invasion of Ukraine in February has had dramatic consequences which cannot be seen to the full extent at the time of writing this report. Beyond the devastating human suffering, consequences to the world economy and markets are likely to be expected. The extent to which the invasion impacts the company’s results will depend on future developments, which are highly uncertain and difficult to predict, including new information which may emerge on an ongoing basis.

Pandion Energy acquires the operations of ONE-Dyas in Norway with an outlook to more than double daily production

The Nova field is expected to start production in the second half of 2022. The field, located in the northern part of the North Sea, is being developed with two subsea templates tied back to the existing Gjøa platform. Nova (previously Skarfjell) was discovered in 2012 and the plan for development and operation (PDO) was approved in 2018. The use of existing infrastructure enables effective extraction of the resources and Nova will be sustainably operated with hydro power from shore through Gjøa.

CEO of Pandion Energy, Jan Christian Ellefsen stated the following:

This transaction represents a new leap in the Pandion story and secures the foundation for further growth. Our asset base is strengthened and, with Nova on stream, our daily production will more than double.

“During the first five years, Pandion Energy has earned its reputation as a trusted partner in exploration and field development on the Norwegian Continental Shelf (NCS). ONE-Dyas Norge fits well with our existing portfolio and organisation and will strengthen our position as an active, full-cycle partner driving value in high-quality assets on the NCS.”

Through its 10 percent ownership in the Valhall and Hod fields, Pandion Energy currently produces over 5,000 barrels of oil equivalent per day, set to increase further as the new Hod B platform comes on stream in 2022. The Valhall area has been fully electrified from shore since 2013. The combined Valhall and Nova production will, in line with Pandion Energy’s Net Zero Carbon strategy, have among the lowest CO2 intensity levels on the NCS.

Jan Christian Ellefsen further points out that Pandion Energy has long indicated plans for further expansion on the Norwegian Continental Shelf:

“M&A activity on the NCS was slow during the first half of 2021, but more opportunities started to occur as we approached 2022. We are still actively searching for and evaluating additional opportunities to further grow our portfolio.”

The transaction is subject to customary conditions for completion, including but not limited to approval by the Norwegian Ministry of Petroleum and Energy.

For more information on ONE-Dyas Norge AS, see: https://onedyas.no/

For more information on Nova, see: https://www.norskpetroleum.no/en/facts/field/nova/