The transaction included Pandion Energy’s:

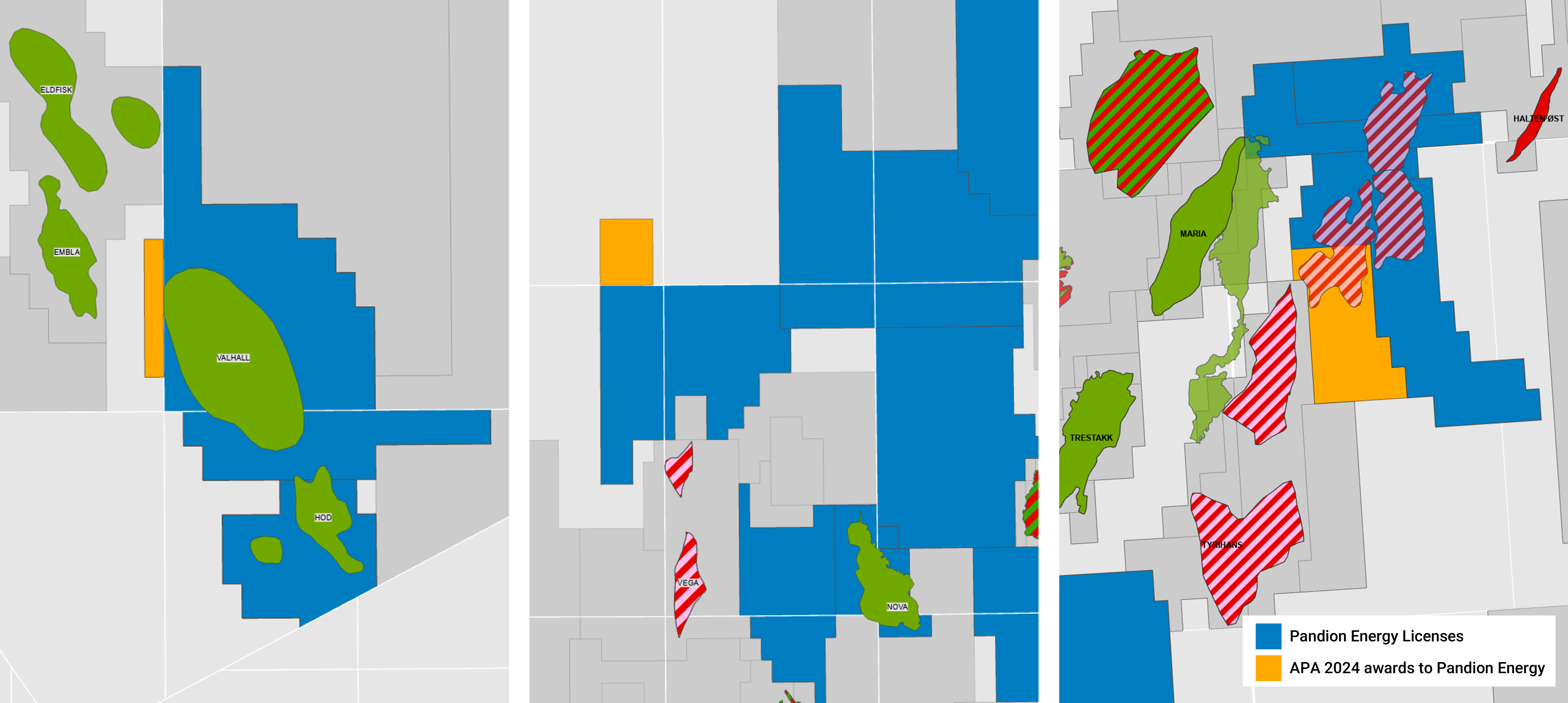

- 10% participating interest in the producing Valhall and Hod fields (PL006B, PL006G, PL033 and PL033B);

- 20% participating interest in the Slagugle discovery (Pl 891 and PL 891B); and

- 20% participating interest in the Mistral discovery (PL1119).

These assets have been core to Pandion Energy’s strategy of creating value through active ownership in high-quality projects close to existing infrastructure. With this transaction, Pandion Energy realises significant value and further strengthens its ability to invest in the next phase of portfolio development.

Jan Christian Ellefsen, CEO of Pandion Energy, stated the following:

“Completing this transaction marks a significant milestone in Pandion Energy’s active portfolio management strategy. The company remains committed to its full-cycle approach. Following the repayment of its bond and reserve based lending (RBL) facility, Pandion Energy will become debt-free, enabling greater financial flexibility to focus on developing its remaining assets and pursuing new growth opportunities in selected core areas on the NCS.”

Pandion Energy retains a producing base through its 10% interest in the Nova field and continues to mature its discoveries, most notably Ofelia and Sierra Solberg, towards the development stage.

Jan Christian Ellefsen, CEO of Pandion Energy, added:

“Since 2017, we have taken part in the transformation of Valhall from a legacy field into a modern hub for continued production and future developments. With this divestment, we are capturing value created both from within our producing asset base and our exploration portfolio. Finally, I want to extend my sincere thanks to the entire Pandion team for their outstanding effort and commitment throughout this journey. I am incredibly proud of what this talented and dedicated team has achieved, and I look forward to continuing our journey together as we shape the next chapter for Pandion Energy.”